Wrkit is now part of Benefex!

Which means that, as well as the great platforms you’d expect for Wellbeing and Discounts, you can now offer a whole range of exceptional employee experiences.

Are you ready for one home for your entire reward, benefits and wellbeing strategy?

Trusted by ambitious companies, globally.

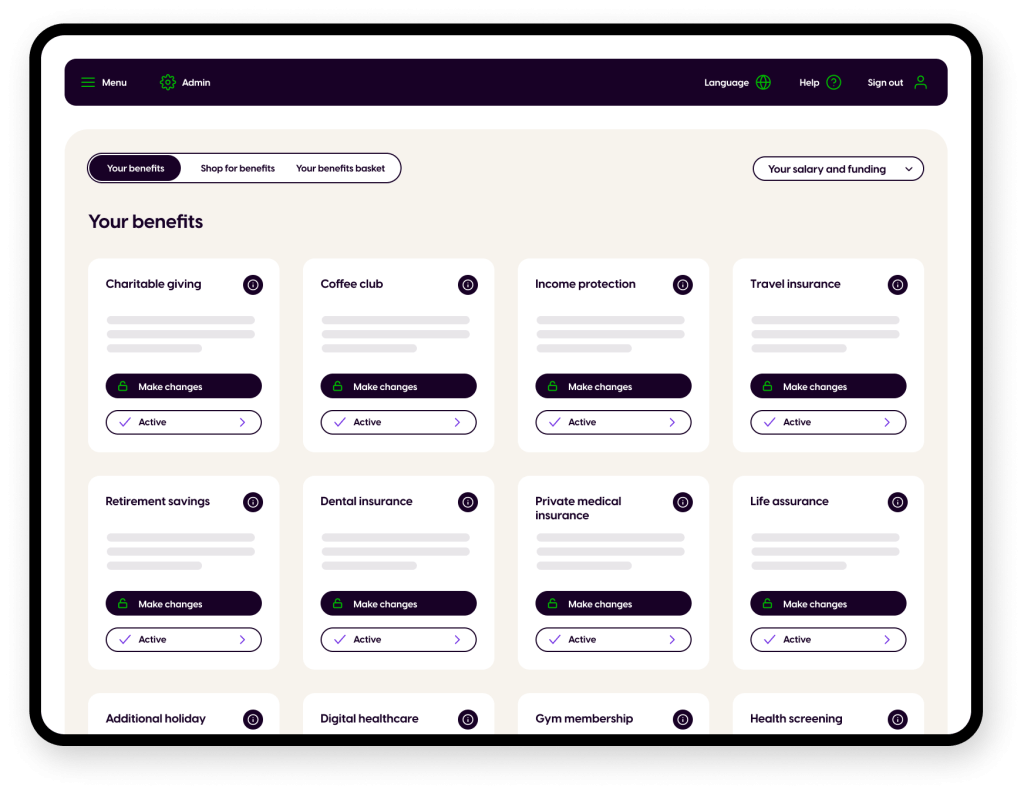

Explore OneHub products

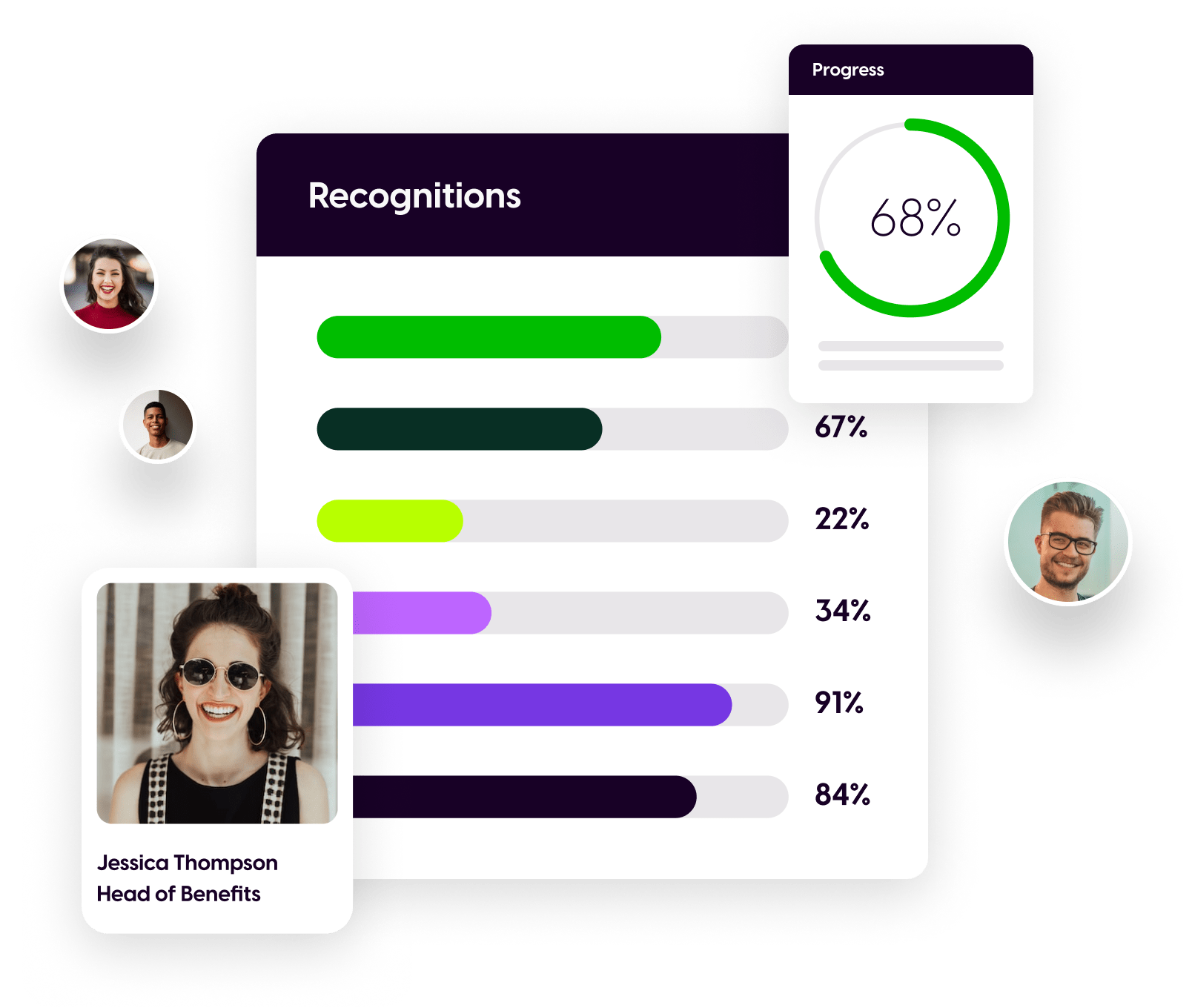

Reduce admin and get a better return on employee experiences

Attract and retain top talent

Drive a consistent employee experience globally

Help your people feel good about coming to work, every day

Improve employee wellbeing and engagement, and keep

your best people

Join the wave of people leaders

2.2m

Employee users

80

Countries

“They are helping us make sure our platforms are adapted to all of the locations we are in whilst maintaining the same level of experience for all of our employees whether they are in China, Miami or Edinburgh.”

Julia Clement, Head of Reward

900

Customers

900

Customers

95%

Customer satisfaction

“Working with Benefex we could quickly begin to imagine how we wanted to build the experience for employees.”

Tatiana Beidar, Head of Compensation and Benefits

Latest resources, events & insights

Partner with a leader in employee experience

2022 Winner

Inspiring Workplaces Awards

Top 25 Work Tech Vendors in the World

2023 Winner

The Sunday Times Best Places to Work Awards

The Sunday Times Best Places to Work Award Big Company: Benefex

2022 Winner

Employee Benefits Awards

Best Flexible Benefits Plan: EDF

Join our community and get the latest updates in the world of HR, reward, and benefits

Ready to connect your employee experience?

Trusted by ambitious companies, globally.